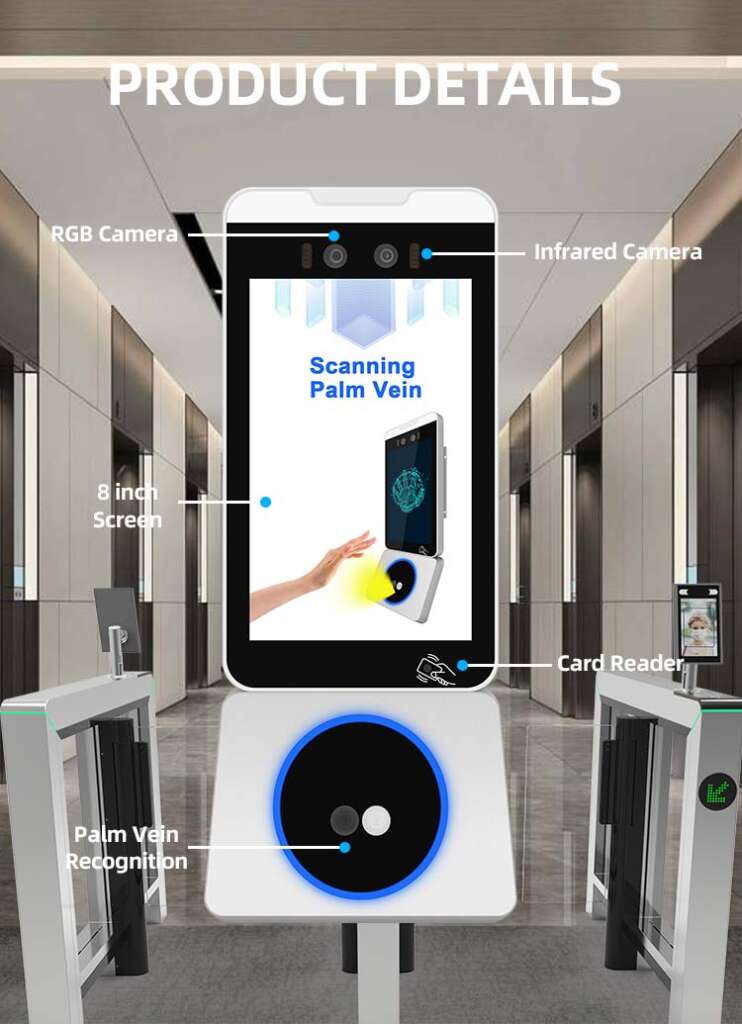

Introduction to Palm Vein Recognition

Palm vein recognition is an advanced biometric authentication technology that utilizes the unique vein patterns in an individual’s palm for identification and verification. Unlike fingerprints or facial recognition, palm vein recognition is a contactless, highly secure, and precise method that has gained significant traction in various industries. In recent years, this technology has seen remarkable adoption in China, particularly in the financial sector. Its ability to ensure secure transactions and combat fraud has made it an essential tool in the rapidly evolving financial landscape.

China, known for its technological advancements and early adoption of innovative solutions, has embraced palm vein recognition to revolutionize the way businesses operate. This technology is playing a pivotal role in enhancing user authentication systems, safeguarding sensitive data, and streamlining financial processes. The unique attributes of palm vein recognition, such as its non-invasive nature and unparalleled accuracy, have made it a preferred choice for banks, fintech companies, and financial institutions in China.

Benefits of Palm Vein Recognition

1. High Security and Fraud Prevention

Palm vein recognition is inherently more secure than traditional biometric methods such as fingerprint or facial recognition. The vein patterns are located beneath the skin, making them nearly impossible to forge or replicate. This provides an added layer of security that is critical in protecting financial transactions and sensitive data from fraudsters and cybercriminals.

2. Contactless and Hygienic

In the wake of the COVID-19 pandemic, contactless technologies have gained prominence. Palm vein recognition is a hygienic alternative to touch-based systems, such as fingerprint scanners, reducing the risk of germ transmission. This feature is especially beneficial in high-traffic areas like banks and public financial institutions.

3. Accuracy and Reliability

The technology boasts an extremely low false acceptance rate (FAR) and false rejection rate (FRR), making it one of the most reliable biometric solutions available. Since vein patterns are unique to each individual and remain unchanged throughout their life, the accuracy of palm vein recognition is unmatched.

4. User Convenience

Palm vein scanners offer quick and seamless authentication, enhancing user experience. The process involves simply holding one’s hand over a scanner, which identifies the user within seconds. This convenience is particularly valuable in the fast-paced financial industry, where time efficiency is paramount.

5. Enhanced Privacy

Unlike facial recognition, which may raise privacy concerns due to surveillance possibilities, palm vein recognition is a more private form of identification. The system requires voluntary participation and cannot be used to track individuals without their consent.

6. Durability Against Wear and Tear

External factors such as injuries, dirt, or moisture do not affect the accuracy of palm vein recognition. Unlike fingerprints, which can be temporarily altered by cuts or abrasions, vein patterns remain consistent regardless of external conditions.

Use of Palm Vein Recognition in the Financial Industry in China

The financial industry in China has witnessed a digital transformation in recent years, with biometric technologies playing a crucial role in enhancing security and user experience. Palm vein recognition is at the forefront of this transformation, being implemented across various financial services to address security challenges and improve operational efficiency.

1. Banking Sector

China’s leading banks, such as ICBC and Bank of China, have integrated palm vein recognition into their authentication processes. Customers can now access ATMs, authorize transactions, and verify their identity simply by scanning their palms. This eliminates the need for physical cards or PINs, reducing the risk of theft or loss.

For example, palm vein-enabled ATMs allow users to withdraw cash without a card, using only their palm as identification. This not only enhances convenience but also mitigates risks associated with card skimming and unauthorized access.

2. Digital Payments

As China continues to lead the global digital payment revolution, palm vein recognition is being adopted by fintech companies to secure mobile and online transactions. Companies like Alipay and WeChat Pay are exploring this technology to enhance payment security and reduce fraud in peer-to-peer and business transactions.

The integration of palm vein recognition ensures that only authorized individuals can access digital wallets and complete transactions. This adds an extra layer of security to payment gateways, fostering trust among users.

3. Loan and Credit Applications

Financial institutions in China are using palm vein recognition to streamline loan and credit approval processes. The technology simplifies identity verification, reducing paperwork and processing time. Applicants can authenticate themselves quickly and securely, allowing banks to expedite approvals and improve customer satisfaction.

4. Enterprise and Corporate Banking

Corporate banking requires stringent security measures due to the high-value transactions involved. Palm vein recognition is being used to authenticate corporate clients and authorize large fund transfers. This technology ensures that only authorized personnel can access sensitive accounts, preventing unauthorized activities.

5. Fraud Detection and Prevention

Palm vein recognition has proven to be a powerful tool in combating financial fraud in China. By verifying the unique vascular patterns of users, financial institutions can effectively detect and prevent identity theft, phishing attacks, and account takeovers. This has significantly reduced fraudulent activities in the industry.

6. Customer Relationship Management (CRM)

Banks and financial institutions are leveraging palm vein recognition to enhance customer relationship management. By linking palm vein data to customer profiles, institutions can deliver personalized services and offers. This fosters loyalty and improves the overall customer experience.

7. Integration with Blockchain Technology

Palm vein recognition is being integrated with blockchain technology to ensure secure and tamper-proof financial transactions. Blockchain’s immutable ledger, combined with the unique identification capabilities of palm vein recognition, offers an unparalleled level of security for high-value transactions and data sharing.

Conclusion

Palm vein recognition has emerged as a game-changing technology in the financial industry, offering unparalleled security, accuracy, and convenience. Its adoption in China highlights its potential to revolutionize the way financial institutions operate, paving the way for a secure and efficient digital economy. As this technology continues to evolve, its integration with other innovations like blockchain and artificial intelligence will further enhance its capabilities, solidifying its role in shaping the future of finance.

With its numerous benefits and applications, palm vein recognition is poised to redefine biometric authentication, making financial systems more secure and user-friendly. China’s proactive approach to embracing this technology sets a benchmark for other countries to follow, underscoring the importance of innovation in driving progress in the financial sector.