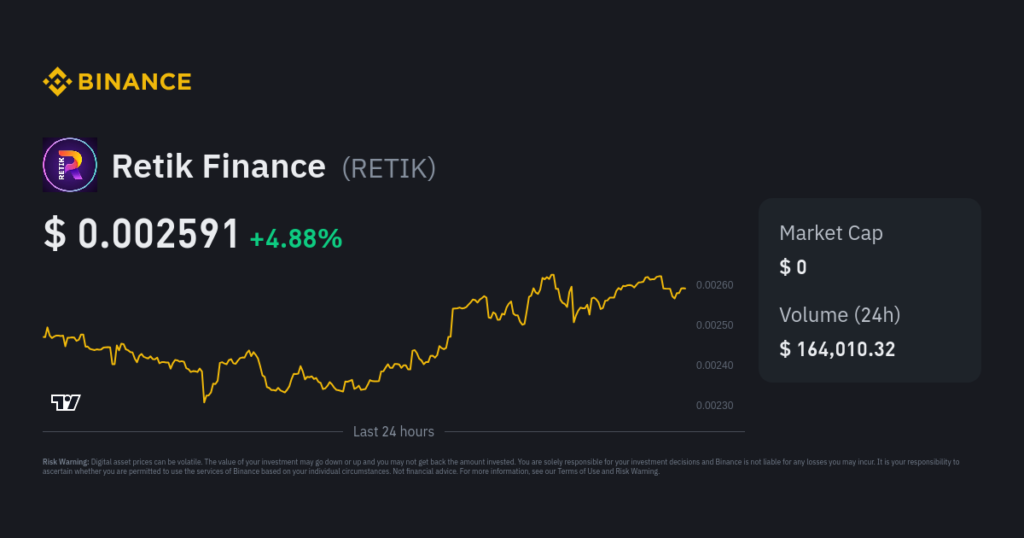

The cryptocurrency marketplace remains a dynamic and rapid-evolving space, offering opportunities and challenges for buyers worldwide. Among the emerging names on this area is Retik Finance (RETIK), a virtual asset that has sparked hobby for its modern approach and market potential. In this article, we are able to explore various sides of the “Retik Finance price prediction 2025,” leveraging insights from key industry assets to provide a complete overview.

What is Retik Finance?

Retik Finance (RETIK) is a decentralized finance (DeFi) assignment designed to provide green, transparent, and stable monetary solutions inside the blockchain surroundings. As a cryptocurrency, RETIK pursuits to disrupt conventional economic structures by enabling peer-to-peer transactions, clever contract capability, and decentralized governance. Its unique use instances and generation stack have made it a topic of hobby amongst crypto fanatics and analysts.

Why Focus on 2025?

The year 2025 represents a pivotal factor inside the cryptocurrency market. With increasing international adoption of blockchain generation, institutional investments, and evolving policies, many experts agree with that the next few years will shape the lengthy-time period trajectory of cryptocurrencies like RETIK. For Retik Finance, 2025 may be a landmark 12 months, reflecting the end result of technological advancements, market developments, and strategic partnerships

Retik Finance Price Predictions for 2025

1. SwapSpace.Co:

SwapSpace predicts that the average charge of Retik Finance in 2025 may want to reach $zero.00344333, offering a ability return on funding (ROI) of 33%. This conservative forecast aligns with the platform’s evaluation of RETIK’s adoption and market performance.

2. CoinCodex:

According to CoinCodex, RETIK’s rate in 2025 could variety between $0.004066 and $0.0114, with a mean anticipated charge of about $0.007733. This optimistic outlook is based on technical signs and market sentiment surrounding RETIK.

3. CoinLore:

CoinLore gives a detailed prediction, forecasting a maximum rate of $0.0110 and a minimum fee of $0.00709 for RETIK in 2025. Their evaluation emphasizes the ability for RETIK to capitalize on growing DeFi adoption.

4. Bitget:

Bitget tasks an notable soar for RETIK, predicting a rate of $0.2515 by using the give up of 2025. This shows a cumulative ROI of +10,382.88%, reflecting the ability for explosive boom in the crypto marketplace

5. DigitalCoinPrice:

DigitalCoinPrice anticipates that RETIK should spoil thru the $0.00657 barrier via the end of 2025, with expenses fluctuating among $0.00556 and $0.00657 in the course of the 12 months. This prediction underscores a consistent yet promising increase trajectory.

6. CryptoTicker:

CryptoTicker’s forecast is many of the most positive, supplying an average price prediction of $five.372 for RETIK in 2025. Such an bold projection indicates full-size marketplace adoption and transformative tendencies inside the crypto area.

7. Gov.Capital:

Gov.Capital affords a extra conservative estimate, predicting a fee of $zero.000001413 for RETIK through December nine, 2025. While this forecast appears careful, it highlights the uncertainties inherent inside the cryptocurrency marketplace.

Factors Influencing Retik Finance Price Prediction 2025

The variability in these predictions stems from numerous elements that might shape RETIK’s charge trajectory:

- Market Sentiment: Positive or terrible sentiment can extensively impact cryptocurrency costs. Social media traits, influencer endorsements, and information coverage will in all likelihood play a critical position in shaping RETIK’s market perception by using 2025.

- Technological Development: RETIK’s capacity to innovate and deliver new capabilities will have an effect on its market cost. Integrating advanced functionalities like interoperability, scalability, and better security ought to raise investor self belief.

- Adoption Rates: As a DeFi task, RETIK’s success relies upon on person adoption. Partnerships with other blockchain projects and increased usage of its platform will probably force demand for RETIK tokens.

- Regulatory Environment: The international regulatory landscape for cryptocurrencies remains uncertain. Favorable regulations ought to propel RETIK’s increase, at the same time as restrictive rules might hinder its development.

- Macroeconomic Factors: Inflation, interest quotes, and monetary balance can not directly effect cryptocurrency markets. RETIK’s fee may be motivated by broader financial developments, especially as extra investors turn to digital property as a hedge towards traditional financial structures.

- Competitive Landscape: The DeFi sector is especially aggressive, with severa initiatives vying for marketplace share. RETIK’s potential to distinguish itself will be important for its long-time period success.

Opportunities for Retik Finance in 2025

- DeFi Expansion: The decentralized finance marketplace is predicted to grow exponentially inside the coming years. Retik Finance, with its particular capabilities and talents, is properly-located to capitalize in this fashion.

- Global Adoption: As blockchain generation turns into greater mainstream, RETIK may want to gain from accelerated adoption throughout diverse industries and geographies.

- Strategic Partnerships: Collaborations with other blockchain tasks, fintech groups, and institutional buyers could enhance RETIK’s credibility and marketplace presence.

- Technological Advancements: Continuous innovation in blockchain era, which includes improved scalability and electricity performance, should make RETIK greater appealing to each retail and institutional buyers.

Risks and Challenges

Despite its ability, Retik Finance faces several demanding situations:

- Volatility: Like all cryptocurrencies, RETIK is problem to considerable rate fluctuations, making it a unstable funding.

- Regulatory Uncertainty: Changes in authorities rules could effect RETIK’s operations and marketplace price.

- Market Competition: With severa DeFi tasks inside the marketplace, RETIK ought to constantly innovate to stay relevant.

- Technological Risks: Security vulnerabilities, scalability problems, and technological disasters ought to undermine investor self belief in RETIK.

How to Approach Retik Finance Investment in 2025

Investing in Retik Finance calls for a balanced method:

- Research: Understand RETIK’s technology, crew, and marketplace ability.

- Diversification: Avoid putting all your investments into a single cryptocurrency. Diversify your portfolio to control threat.

- Risk Assessment: Assess your danger tolerance and make investments only what you can afford to lose.

- Long-Term Perspective: Given the volatility of cryptocurrencies, a long-term funding horizon may additionally yield better effects.

- Stay Informed: Keep tune of market tendencies, information, and updates associated with RETIK and the broader cryptocurrency atmosphere.

Conclusion

The “Retik Finance charge prediction 2025” encapsulates the capacity and demanding situations of making an investment in this promising cryptocurrency. While forecasts range extensively, they underscore the dynamic and unpredictable nature of the crypto marketplace. By considering marketplace trends, technological improvements, and professional insights, buyers could make informed selections about their involvement with Retik Finance.

As with any investment, due diligence is vital. Retik Finance’s future will rely on its capability to navigate market complexities, supply progressive solutions, and construct a robust community. Whether you’re an experienced investor or new to the crypto area, Retik Finance offers an exciting opportunity to discover the evolving international of decentralized finance.